Risk assessments for AML decisions you can rely on

Built to assess risk consistently, automatically and with evidence.

First AML ensures risk assessments are completed, applied and evidenced across every client and matter - with assessments that adapt to different practice areas, offices and risk profiles - turning policy into action and backing decisions with solid proof.

Proportionate by design

Get to defensible risk decisions faster

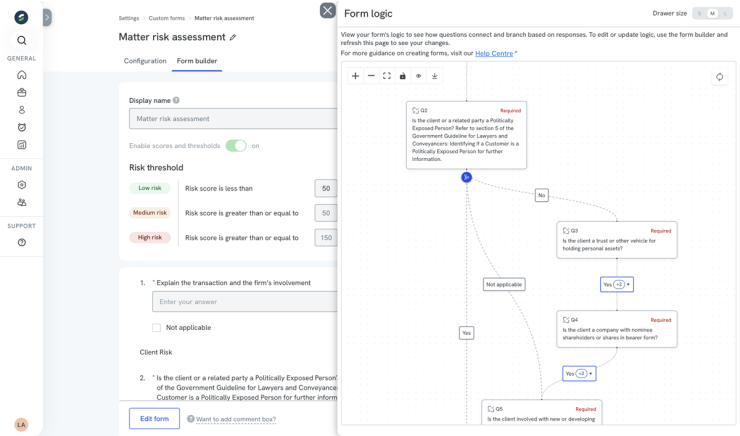

Configure dynamic risk assessments with branching logic so teams only answer questions that are relevant to the client and matter.

Weighted scoring reflects your firm’s risk appetite without forcing blunt, one-size-fits-all outcomes.

Controls that enforce themselves

Turn risk scores into automatic controls

Set risk thresholds that enforce next steps. When a client reaches a defined risk level, required actions like Source of Funds checks or senior review are applied automatically, based on rules approved by the MLRO.

Consistency you can prove

Assess consistently across every file

Default questionnaires ensure every new client starts with the same baseline approach.

Risk levels are calculated consistently and synced to client profiles, keeping decisions aligned as matters progress and risk changes.

How it works

Step 1.

Build your risk rules

Turn your AML policies and risk framework into structured questions, scoring and rules.

Step 2.

Set risk triggers by level

Define what low, medium and high risk require. Controls trigger automatically when thresholds are met.

Step 3.

Create unique assessments

Create different risk assessments, question sets and scoring models for practice areas, offices or jurisdictions.

Step 4.

Review and renew

Update rules, triggers and requirements as your business, regulations and threats change.

Evidence why you said yes or no.

Decisions you can trust, backed by auditable records and a clear decision trail.

Every decision is traceable

Every answer, override and judgement is recorded directly on the risk assessment, with full version history and change tracking.

Full context, one place

Decisions sit alongside the risk assessment, evidence and communications in one case file, preserving full context from start to finish.

Instant audit

When regulators ask how a decision was made, you can show the assessment, the rationale and the rules in force at the time; without reconstructing the story.

Frequently Asked Questions

How does First AML ensure risk assessments are completed and kept up to date?

First AML embeds risk assessments directly into client and matter workflows, using your own default questionnaires and automated completion rules to ensure they are done every time. Assessments can be reviewed, updated and renewed as risk changes, with full version history retained so outdated or missing assessments don’t undermine AML decisions.

Can risk assessments be different for different practice areas, offices or jurisdictions?

Yes. First AML allows firms to create multiple risk assessments tailored to different practice areas, offices or jurisdictions, while maintaining firm-wide oversight. This supports proportional, risk-based assessments without forcing a one-size-fits-all model across the business.

How do risk assessment scores trigger AML actions like Source of Funds or Enhanced CDD?

Risk scores are measured against thresholds set by you Head of Compliance. When a defined risk level is reached, required actions such as Source of Funds checks, enhanced due diligence or senior review are applied automatically. This ensures your risk appetite is enforced in practice, not left to manual judgement.

How does First AML help evidence AML decisions during audits or inspections?

All risk assessment answers, overrides and rationale are recorded with full change tracking and version history. Decisions sit alongside supporting documents and communications in a single case file, creating a clear, auditable decision trail that can be presented instantly to regulators.

How does First AML support proportionate, risk-based decision-making?

First AML uses dynamic, branching risk assessments and weighted scoring to focus on relevant risk factors rather than generic checklists. This allows teams to assess risk proportionately based on the client and matter, while ensuring decisions remain consistent, evidence-based and defensible.

How do firm-wide AML policies and risk assessments apply at client or matter level?

First AML translates firm-wide AML policies and risk appetite into structured risk assessments used on every client and matter. This ensures file-level decisions consistently reflect the firm-wide risk framework, with clear evidence of how policies are applied in practice.

Why firms trust First AML

Built on real AML experience

We processed over 2 million AML cases ourselves before building the platform - so it’s shaped by what works in practice.

Local support that understands compliance

Our Customer Success team is based in-market and works alongside local firms and consultants to help turn policies into day-to-day workflows.

Solutions, not sales pitches

We take a solution-led approach, configuring First AML around your risk framework, operating model and regulatory context.

See First AML in action.

The only AML platform you need to run world-class onboarding.