Streamline your AML process.

The First AML platform adapts to your business and follows the latest legislative landscape.

1. Create

With the First AML platform, you can create a case in 2 ways: on the First AML platform, or by leveraging our public API.

You'll also be able to determine the type of KYC verification you'd like to conduct on the case.

2. Assess

Once your case is created, send out the Risk Assessment questionnaire to assess the level of risk of your customer.

If you're verifying an entity, you'll be able to automatically unwrap the entity structure and easily identify the UBOs and PSCs that you need to verify with our KYB Inspect functionality.

3. Collect

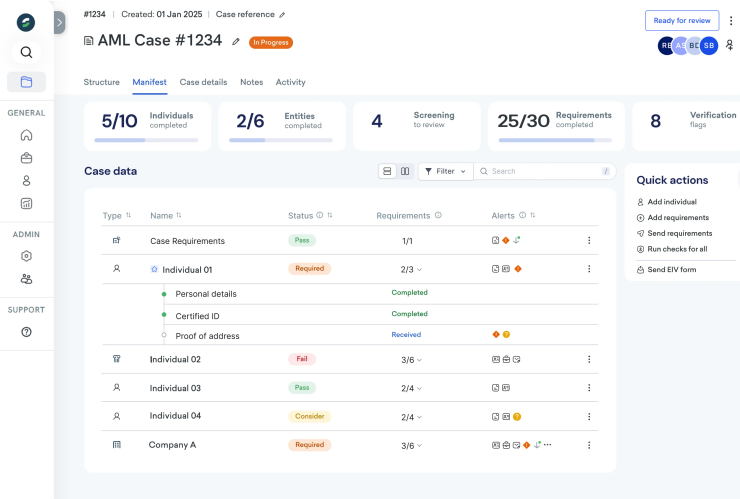

Document collection has never been easier with First AML!

Aligned with regulatory guidelines, the First AML Manifest provides a list of recommended documentations and steps you need to take to verify your client, including Source of Funds (SOF) and Source of Wealth (SOW) collection.

If the case requires an Electronic Identity Verification (eIDV) check, you can choose to do it via the First AML's secure platform or an embedded EIV form on your website.

4. Verify

First AML plugs into 100+ global data sources to ensure thorough verification results.

When hits are identified, false positives are automatically flagged as such, removing the time burden from the compliance team, ensuring you only review genuine matches.

5. Review & Maintain

Easily view, review, and export your securely stored cases from our customisable dashboard for reporting and audits.

For ongoing monitoring, simply tick a box to receive alerts on PEP, sanctions, or adverse media status changes.

Click 'Start' to explore the First AML platform.

"First AML has significantly accelerated our onboarding process. We now onboard clients 8 times faster than before."

Ghassan Badran, MLRO, Meysan Partners